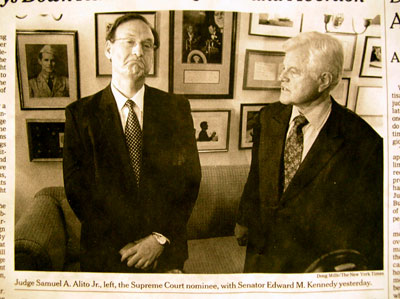

Court Nominee Deals With Ethics Criticism

Friday November 25, 2005 9:16 PM

By GINA HOLLAND

Associated Press Writer

WASHINGTON (AP) - Judge Samuel Alito has said he did not break a federal ethics law when he ruled in a case involving the company that handles his mutual fund investments.

Legal experts are divided over whether Alito did anything wrong in the case three years ago. Of more immediate concern is his explanation of his role in that case - along with questions about what his recusal practices will be if confirmed to the high court.

Judges, including Supreme Court justices, are required by law to stay out of cases in which they have a financial stake. Members of the high court, however, decide for themselves when to recuse with no oversight.

Alito serves on the 3rd U.S. Circuit Court of Appeals in Philadelphia and has most of his money in mutual funds. When he joined the court in 1990 he told senators he would avoid cases in which Vanguard Group was a party.

Senators questioned him about the 2002 Vanguard case, which was the subject of a conflict of interest complaint filed by the woman who lost her lawsuit. Alito withdrew after first ruling against her and the decision was reaffirmed without his participation.

Alito and the White House have offered several explanations: that a computer glitch allowed the disqualification issue to slip through undetected, that Alito's 1990 pledge to stay out of Vanguard appeals only applied to his initial service, and that the promise was ``unduly restrictive.''

``The explanation causes greater concern than the problem,'' said Stephen Gillers, a professor specializing in legal ethics at New York University's School of Law. ``It would have all gone away if Judge Alito had said, `This was an oversight.' People can forgive oversights. We all have them.''

Doug Kendall, executive director of the Community Rights Counsel, a public interest law firm, said the response was ``inconsistent and somewhat incoherent.''

``His explanation has made it an issue that will continue through the (Senate) hearings,'' said Kendall.

Judges who have even one share of stock in a company are not allowed to rule in cases involving that company. Because of that, recusals are common at the high court.

Steven Lubet, an ethics expert at Northwestern University, said the rules for judges and their mutual funds is not clear. If the mutual fund company is compared to a bank, which just holds deposits, then recusals are not required.

Lubet said that Alito should be praised for keeping the bulk of his money in mutual funds instead of in individual stocks.

Alito reported holdings of about $80,000 in Vanguard funds when he was confirmed in 1990. Last year he reported shares in 14 Vanguard Group mutual funds, worth $455,000 to $1 million.

Nominated late last month by President Bush, Alito would replace retiring Justice Sandra Day O'Connor, who has extensive stock holdings.

O'Connor has had about 730 recusals during her 24 years on the court, according to Goldstein & Howe, a Washington law firm that tracks Supreme Court statistics.

New Chief Justice John Roberts has already had several major recusals, including one that followed an acknowledgment that he wrongly participated in a case. He took himself out of a patent infringement case the same week that he and the other justices picked the case for review. The conflict apparently was related to his former law firm, Hogan & Hartson.

Like Roberts, who also had served as an appeals court judge, Alito as a justice would be sidelined in a few cases he previously ruled on.

Justices recently agreed to hear a prison lawsuit in which Alito argued that states should be allowed to restrict inmates' reading material. The appeals court found that the rules were an unconstitutional restriction on free speech.

Roberts and Alito also have family legal ties, which could prompt them to step aside in some cases. Roberts' wife is a partner with a prominent Washington law firm. Alito's sister is a lawyer in New Jersey.

Members of the Senate Judiciary Committee should question Alito sharply during his confirmation hearings in January about what his recusal policies will be, said Kendall, because ``once confirmed, a justice has unreviewable discretion in this area.''

Gillers said the criticism about the mutual fund case might have a long-term impact.

``This experience may have had a personally bruising effect on Judge Alito. If he gets onto the court he might err on the side of recusal to clear his name,'' Gillers said.

On the Net:

Supreme Court: http://www.supremecourtus.gov/

LinkHere

0 Comments:

Post a Comment

<< Home